A rental real estate investment can seem like a great way to build your wealth (and maybe generate a little extra income), but how often does it really work out that way?

Owning a rental property in addition to your primary residence can be a way for you to build wealth, especially if you may be averse to investing in the stock market. Data released in 2017 shows that 47% of rentals were owned by individual investors. In theory, it seems to make sense. With a rental property, someone else pays your mortgage, and over time your equity grows. You can eventually own a physical piece of property outright that also produces income. However, rental property investments aren’t always a sure thing.

The first home my wife and I bought was a condo in 2004 in Stamford, Conn., which we then in turn rented out when we bought our first single-family home. Our situation didn’t work out for a number of reasons, mainly because 1) the property, after a rising as high as 30%+ over our purchase price, ended up selling for only a 5% gain. 2) We needed to make updates (kitchen countertops and floors) and repairs (HVAC system) that ate away at our profit. 3) With the great recession rental prices dropped and lowered my expected return, and we also had a few months where the property was empty.

So, as you can see, things that seem too good to be true often are. So, before you decide to invest in a rental property, consider calculating the return on your investment to see if investing in a rental property is really the deal you thought.

How to Calculate the Return on Investment of a Rental Property

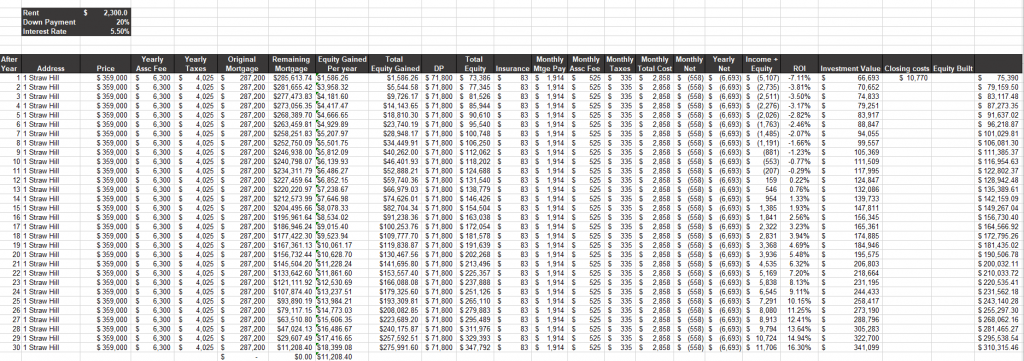

Like any investment, you need to understand the expected return on investment (ROI). ROI = (Net Profit/Cost of Investment) x 100. Therefore, before you purchase a rental property, ask what return is reasonable to expect on your money, and what do you need to earn in order for the investment to be worthwhile?

Calculating the ROI of a rental property can be complex. While there are many different ways to do this, the point of this exercise is to provide you with a “back of the envelope” calculation to help you quickly assess whether or not a rental property has a return potential that is worth pursuing. If your calculation reveals that the return is small on paper, it’s likely going to be small in reality, too.

Before you can calculate the true ROI of a rental property, you have to factor in all the costs associated with holding that property, not just the purchase amount.

For illustrative purposes, I’ve put together a rental property ROI calculation to demonstrate how complex this mathematical exercise actually is.

What to Factor into a Rental Property ROI Calculation

While the initial cost of investment should be straightforward (purchase price, closing costs, renovations to get it ready), determining your net profit (revenue — expenses) can get tricky. When calculating your own net profit, don’t forget these variables:

Revenue

-

Rental Income: How much you can charge for rent each month.

-

Mortgage paid down: How much of the property you own.

-

Change in property value: How much additional equity you have beyond the amount of the mortgage you have already paid down, based on current housing and rental market prices.

Expenses

-

Financing: If you didn’t buy the property with cash and took out a mortgage, the amount you pay per month in principal and interest.

-

Homeowner’s association dues: Fees you pay for community amenities.

-

Property insurance: The insurance you carry on your property.

-

Property taxes: What you pay in state and local taxes. And remember, property taxes don’t typically stay the same each year. They typically continue to rise unless an economic downturn allows you to have the property reassessed (typically for a fee) and readjusted downward.

-

Vacancy: The amount of cash you need to cover expenses when you don’t have a tenant. The standard vacancy rate is 5% to 8%, meaning that’s the percentage of the year that the property can be expected to sit empty.

-

Your time: The one item many people forget to account for is the cost of their own time. Whether it’s time spent as the handyman or finding a renter, your time is money, and anytime you put into managing the property reduces the return on your investment.

My “back of the envelope” calculation doesn’t even account for any management or maintenance costs of the property. Properties always require maintenance. This number is hard to generalize, as every property is different, but just know that something will break, appliances will need to be upgraded, and ongoing resources will be required to keep your property maintained and competitive in the rental market.

In addition, this calculation should be done for every year you anticipate owning the property, as your return will change over time.

Conclusion

Rental properties can generate income, but the return on investment doesn’t typically happen right away. Rental property investments are also risky because of how many variables can affect its performance, like the housing market or your ability to keep it rented. So, if you are wondering if you should invest in real estate, really consider how appropriate this type of investment would be for you and your situation first.

As with any investment, rental properties should be viewed as a long-term investment, not an instant cash cow. If your goal is to grow wealth, I will tell you that there are other ways to generate a return on your income with less risk and headache, like investing in a globally diversified portfolio of stocks and bonds.

What has been your experience with rental properties and being a landlord? Do you agree that, as an investment, it takes a while to reap a reward, or has your experience been different?

Source: Kiplinger, 1st November 2018, Paul V. Sydlansky (Photo: Getty Images, Spreadsheet: Paul V. Sydlansky)