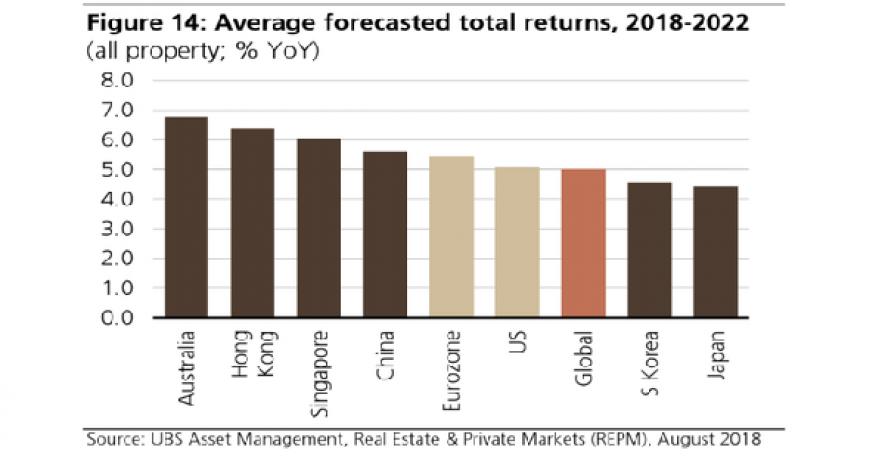

However, it lags behind Australia and Hong Kong.

Investors would do well to invest in real estate despite the cooling measures that have hit sentiment as average forecasted returns in Singapore’s property market for 2018-2022 are poised to beat the Eurozone, the US and even the global average, according to UBS.

Singapore ranked third in APAC markets with forecasted total returns for all property as it trails behind Australia and Hong Kong whilst China was able to nab fourth place.

“In developed markets such as Japan, Australia and Singapore, the already strong property market fundamentals will be further enhanced by the increased regionalisation of investment and capital flows,” the report’s authors said.

It helps that the region enjoys a favourable combination of high economic output and enhanced risk buffers that have resulted in a positive return profile for its property markets. In fact, between 2008 and 2017, major developed APAC countries have delivered total returns that are higher than the global benchmark at a lower volatility rate than developed markets like the US and UK.

UBS added that the growing maturity of the property market including South Korea and Japan is poised to lead to a substantial expansion of stock of institutional grade real estate as well as the availability of capital.

Total assets under management held by APAC institutional investors is projected to hit US$18.6t by 2020 from US$14.8t in 2014, data from CBRE show.

Source: Singapore Business Review, 25th October 2018, Staff Reporter